Budget 2023/24

On Wednesday 18th January, Newbiggin by the Sea Town Council agreed its budget for 2023-2024 and the amount of precept it would be levying on the County Council.

On Wednesday 18th January, Newbiggin by the Sea Town Council agreed its budget for 2023-2024 and the amount of precept it would be levying on the County Council.

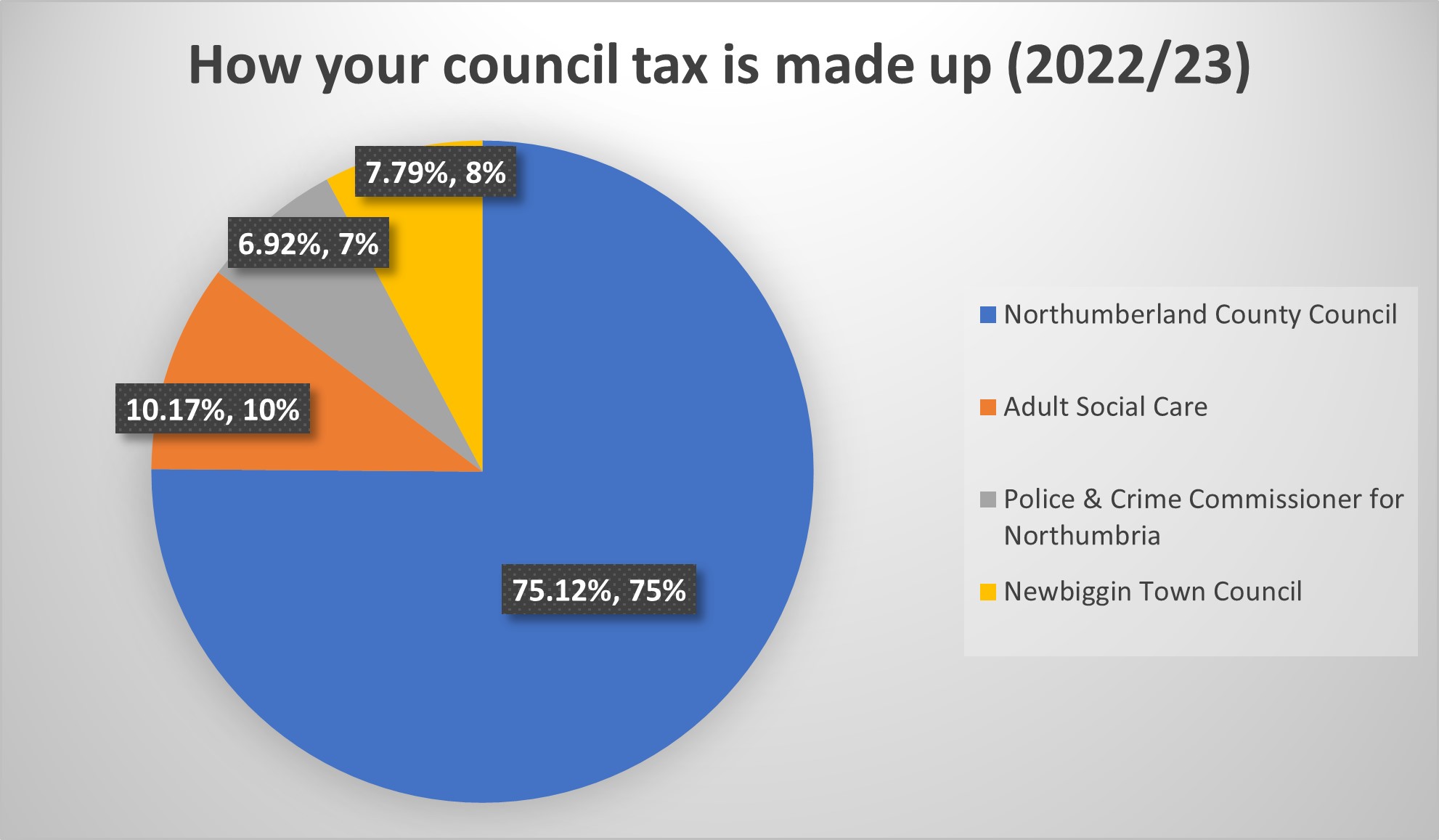

The Town Council precept is the portion the town council receives from the council tax you pay each year and plays an important role in maintaining and improving local services and facilities, supporting local organisations and activities, and influencing development.

Parish and Town Councils are the first tier of local government and are the closest to the community they serve. Newbiggin by the Sea Town Council is the only statutory public authority who’s only focus is on the Newbiggin by the Sea Parish and the residents that live here.

Money spent by the town council only gets spent in the local area from which it is collected. That means that every penny of the precept remains in Newbiggin by the Sea. Last year just less than 8% of the Council Tax ratepayers paid came to Newbiggin Town Council. The Town Council receives no income from businesses through business rates.

With budgeted expenditure of £306,200 the town council recognised the current cost of living crisis and the hardship faced by many and was keen set the precept so that there is no increase to the amount each household contributed towards our precept. The last increase seen per household was in 2019/20. We also agreed that it was not sustainable to freeze this again in the future without services deteriorating. If we want to maintain local services in 2024/25 would need to increase the precept to allow this, we will however spend the coming year looking at alternative means of generating income to avoid future increases if possible.

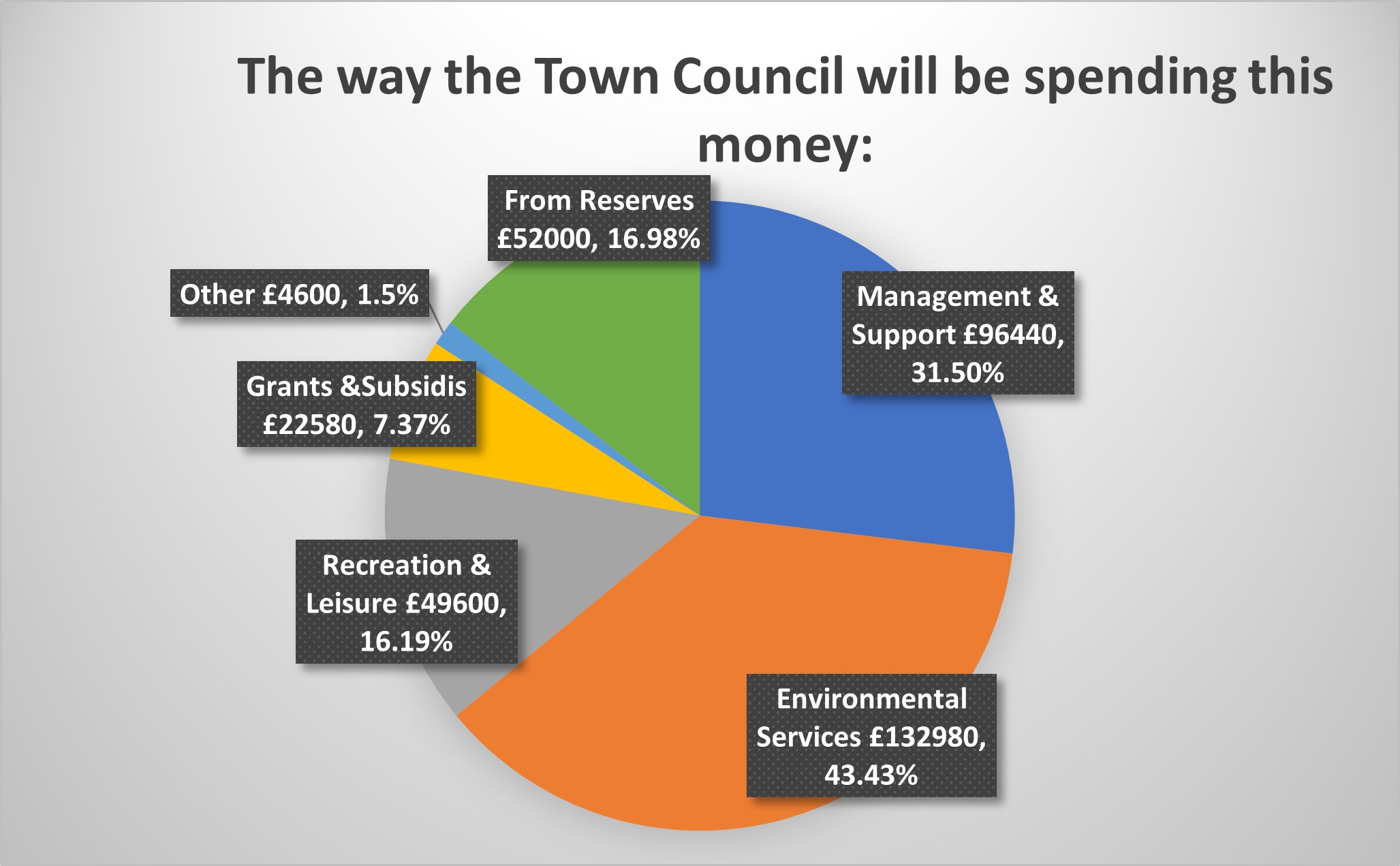

Council tax is calculated using a Base Rate which is 1466.16 for the year 2023/24 for the Newbiggin Parish. The base rate has increased by £31.76 from the rate for 2022/23 (£1434.40) – this is due to the fluctuations in the number of properties contributing towards council tax within the parish. The more properties occupied and the more residents in employment means that the council tax is spread across more households. This small increase in the tax base allows us to increase the precept by £5505 to an amount of £254,200 at no extra cost to the ratepayer. A £52,000 from balances will also contribute to achieve the required budget.

Band D is the middle band of Council Tax and represents the amount of Council Tax paid on an average property in the area. However due to the rateable values being so low in Newbiggin most households pay Band A council tax. Band D will remain at £173.38 per household and Band A will remain at £115.59 per household for 2023/24.

£276,620 of the budget is the core budget – this is our revenue costs to maintain existing services.

The money taken from reserves will contribute to projects that we are planning in the future for example:

- an event to celebrate the Coronation of the King Charles III,

- restorations to Memorial Park – we will commemorate the centenary of the unveiling of this war memorial in 2024,

- continuing improvements to Milburn Park, and

- improvements throughout the town.

A full copy of the budget is available on the following link: Budget 2023-24